The

automobile growth story in India is double-layered: on the face of it, a mere

4-5% sales growth, 45-50% capacity utilization and profit margins under

pressure in the previous fiscal.

Pawan Bansal MD

of Altius Finserv Private Limited says "We expect India to become the

third largest sales market, and production to reach 6 million units a year by

the end of the decade. If Suzuki Motor is creating more capacity in India,

Honda is looking to enter new segments. Renault, Nissan and Volkswagen on their

part are building new capacity for exports while Ford and Fiat have both the

domestic and export markets in mind.

Here's

the break-up of the committed investments: 10 car makers have invested around

Rs 31,570 crore, two-wheeler companies, nearly Rs 8,555 crore and tyre

companies around Rs 7,350 crore in the past 10-12 months to build additional

capacity of three million vehicles, according to PwC. That works out to nearly

a third of the current Indian automotive market.

"Brand

India has been reinforced globally by the Make in India initiative. Japanese

auto major Honda is investing Rs 3,565 crore in its two wheeler and car

businesses in India as it looks to hike production capacity. With both its

businesses having a dream run in the country, some of the Honda branded

vehicles has been on a protracted waiting period, as the company struggles with

capacity. The plan is to increase manufacturing capacity by 600,000 units for

two-wheelers and by 60,000 units for cars by 2016.

India's

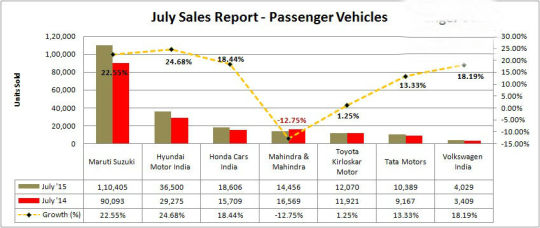

largest utility vehicle and tractor major, Mahindra & Mahindra, which lost

its No. 3 position to Honda is preparing for a comeback. The company plans to

raise Rs 5,000 crore from the market for plant expansion, besides investing Rs

3,500 crore in capex and new investment every year over the next three years.

For

auto makers, expansion plans are based on long-term projections and investment

companies like Altius

Finserv play a vital role in growing business. The market needs to grow at least

10% a year to absorb the additional capacities; there is always the risk of demand

not improving, leaving companies saddled with high manufacturing cost, said a

senior official of a car company who did not wish to be named.

Still,

every car maker has done its homework and sees a potential in more investments

in India. Car makers are making India an export hub for markets such as Africa,

Latin America and the Middle East. The auto sector went through a rough patch

for a good part of the previous year (2014-15), but the overall numbers and an

8% growth indicate hope.